per capita tax in pa

It can be levied by a municipality andor school district. Individual Taxpayer Mailing Addresses.

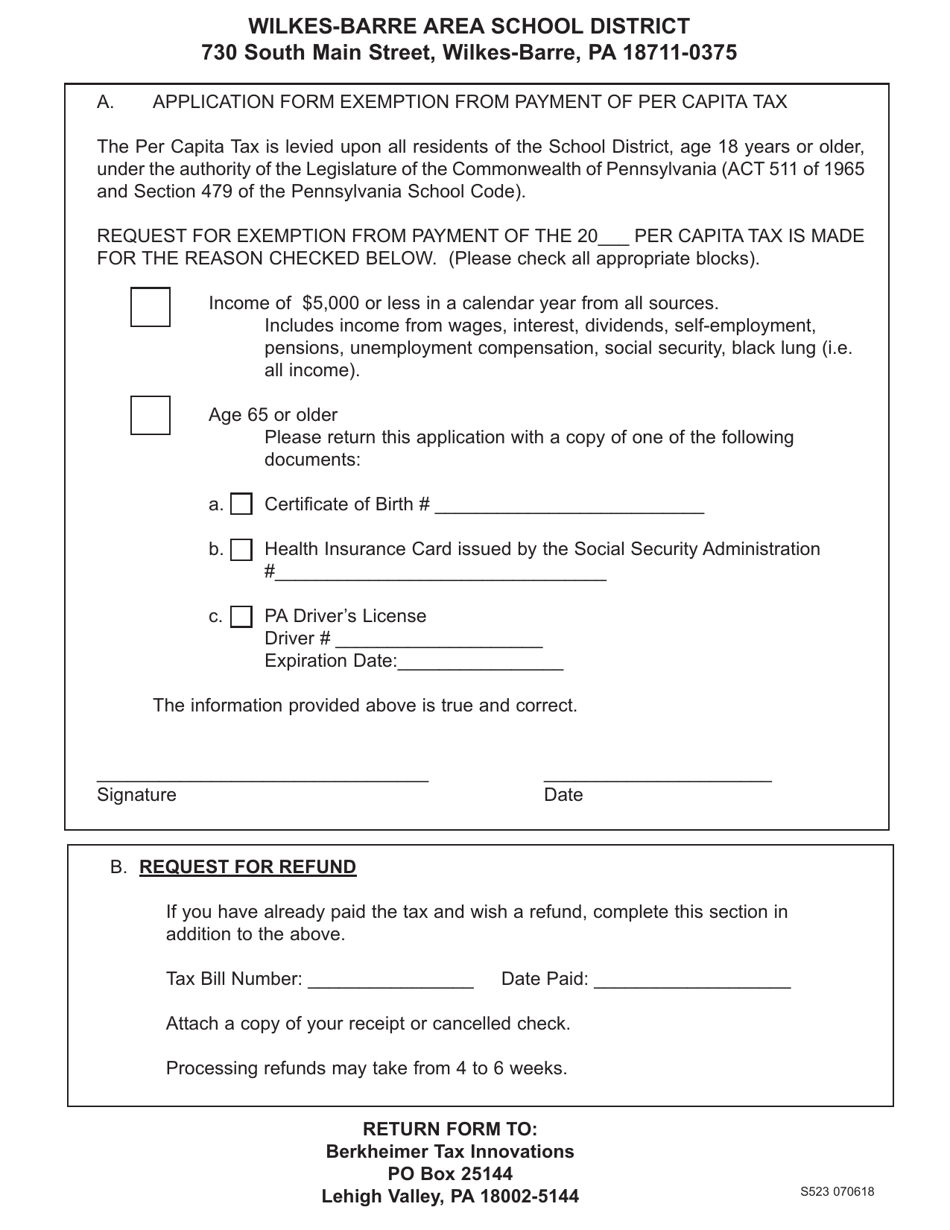

Form S523 Download Printable Pdf Or Fill Online Application Form Exemption From Payment Of Per Capita Tax Wilkes Barre Area School District Pennsylvania Templateroller

PA State Law requires counties to maintain a personalper capita tax roll that lists all individuals by their job title occupation and assessment.

. The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which. The application form may be used by a PA taxpayer whose community has adopted one or.

If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please call Susan E. For most areas adult is defined as 18 years of age and older. Access Keystones e-Pay to get started.

This will give you tax revenue per capita in a given year. Per Capita Tax Roll. The following shall apply.

Per Capita Tax bills for the City County and School are mailed by August 1st for the current year. Links for Individual Taxpayers. Act 511 Taxes for Pennsylvania School Districts Glossary of Terms.

This will give you tax revenue per capita in a given year. Divide the income tax revenue by the taxable population. The Per Capita Tax bill is sent in July.

The municipal tax is 500 and the. Business Gross Receipts Tax. FAQ for Individual Taxpayers.

Information About Per Capita Taxes. If you own your own home the per capita tax is added onto your real estate tax bill. If you rent or reside with someone in Monongahela you will.

The Per Capita Tax imposed by the North Allegheny School District is also collected by the Town of McCandless. The Per Capita Tax rate is 1000 ten dollars. If both do so it is shared 5050.

Per Capita means by head so. Per capita exemption requests can be submitted online. The City of Meadville imposes a tax on all residents over the age of 18 in the City.

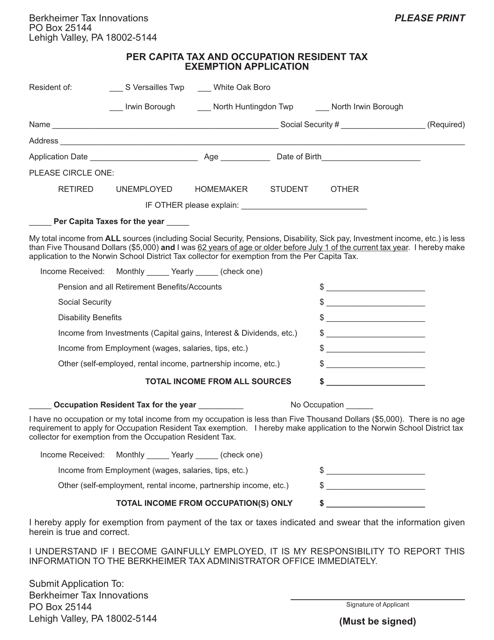

Act 511 of 1965. Motor and Alternative Fuel Taxes. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing.

This tax applies to all residents of the Town of McCandless age 21 and over. What is per capita tax calculation. ACT 679 Tax is.

What is per capita tax calculation. Sales Use and Hotel Occupancy Tax. Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Per Capita Tax PCT Occupational Assessment Tax OAT The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdictionFor most areas adult. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000. The list must also include.

With an estimated population of 95112 as. Act 511 Taxes Flat Act 511 Taxes Proportional Amusement Tax. Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Divide the income tax revenue by the taxable population. Earned Income Tax Regulations.

Tax Types and Information. 1 Except as provided in paragraph 2 the authority of any independent school district to levy assess and collect any tax under the act of December 31. Section 6-679 - Per capita taxes.

Per Capita Tax Burden Is Misleading Public Assets Institute

List Of Pennsylvania Counties By Per Capita Income Wikipedia

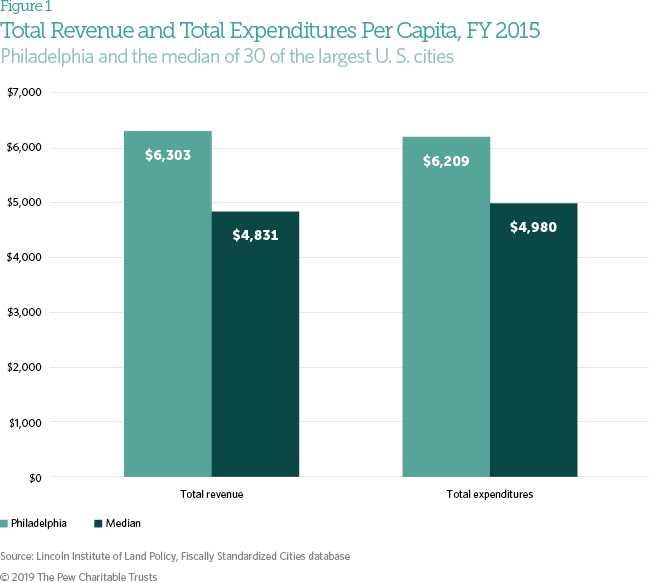

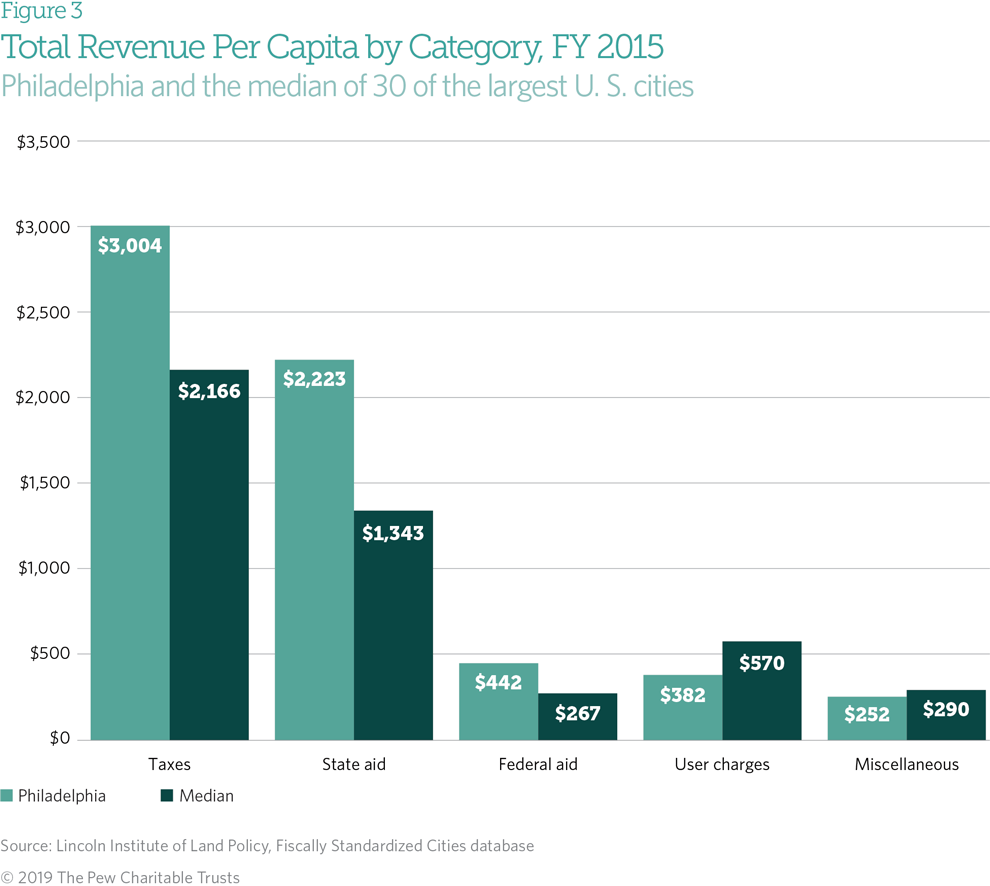

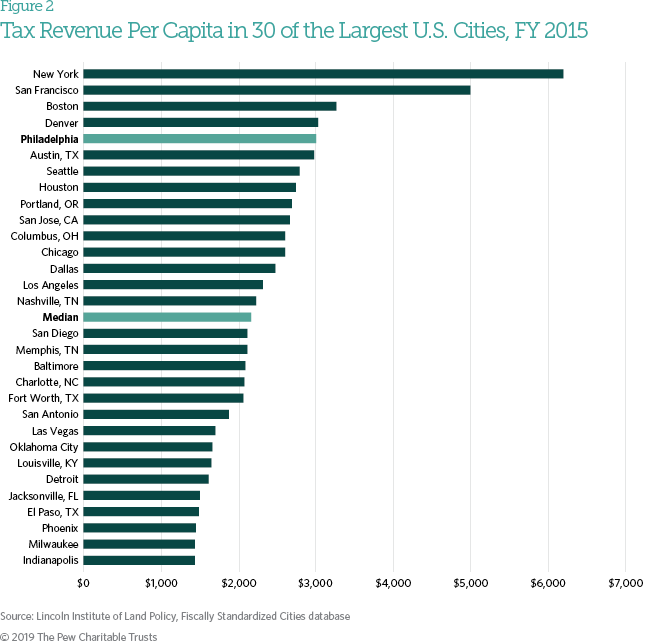

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

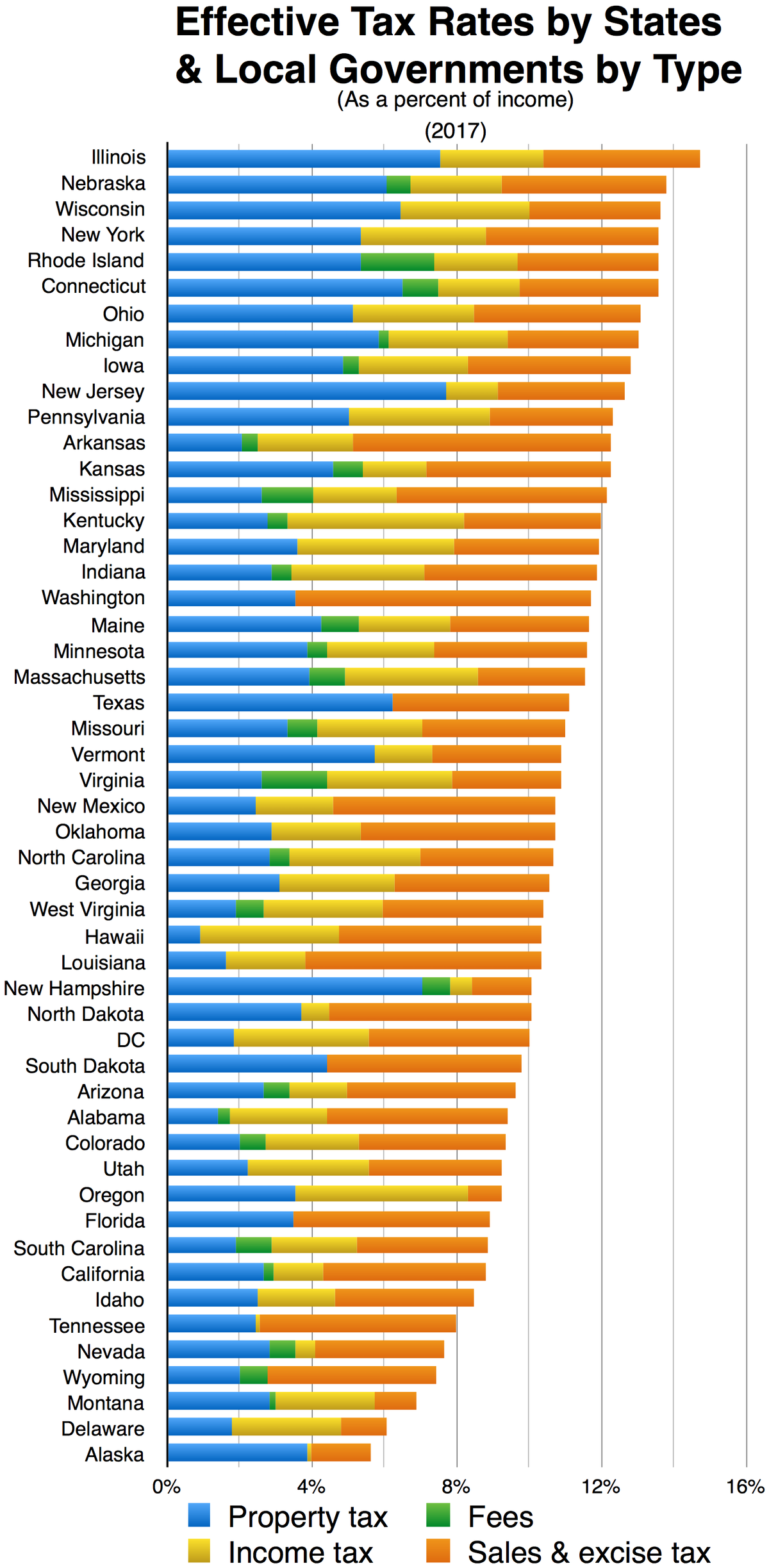

File State And Local Taxes Per Capita By Type Png Wikipedia

Snapshots On State Personal Income Tax Collections

Randee A Scritchfield Wrightsville Borough Tax Collector

State And Local Tax Collections Per Capita In Your State

Pennsylvania Per Capita Tax And Occupation Resident Tax Exemption Application Norwin School District Download Printable Pdf Templateroller

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

Official Web Site Of Mount Pleasant Pa A Borough In Westmoreland County

Push To Eliminate Pa Property Taxes Would Have Major Implications For Schools Prioritizing Homeowners Whyy

Information About Per Capita Taxes York Adams Tax Bureau

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

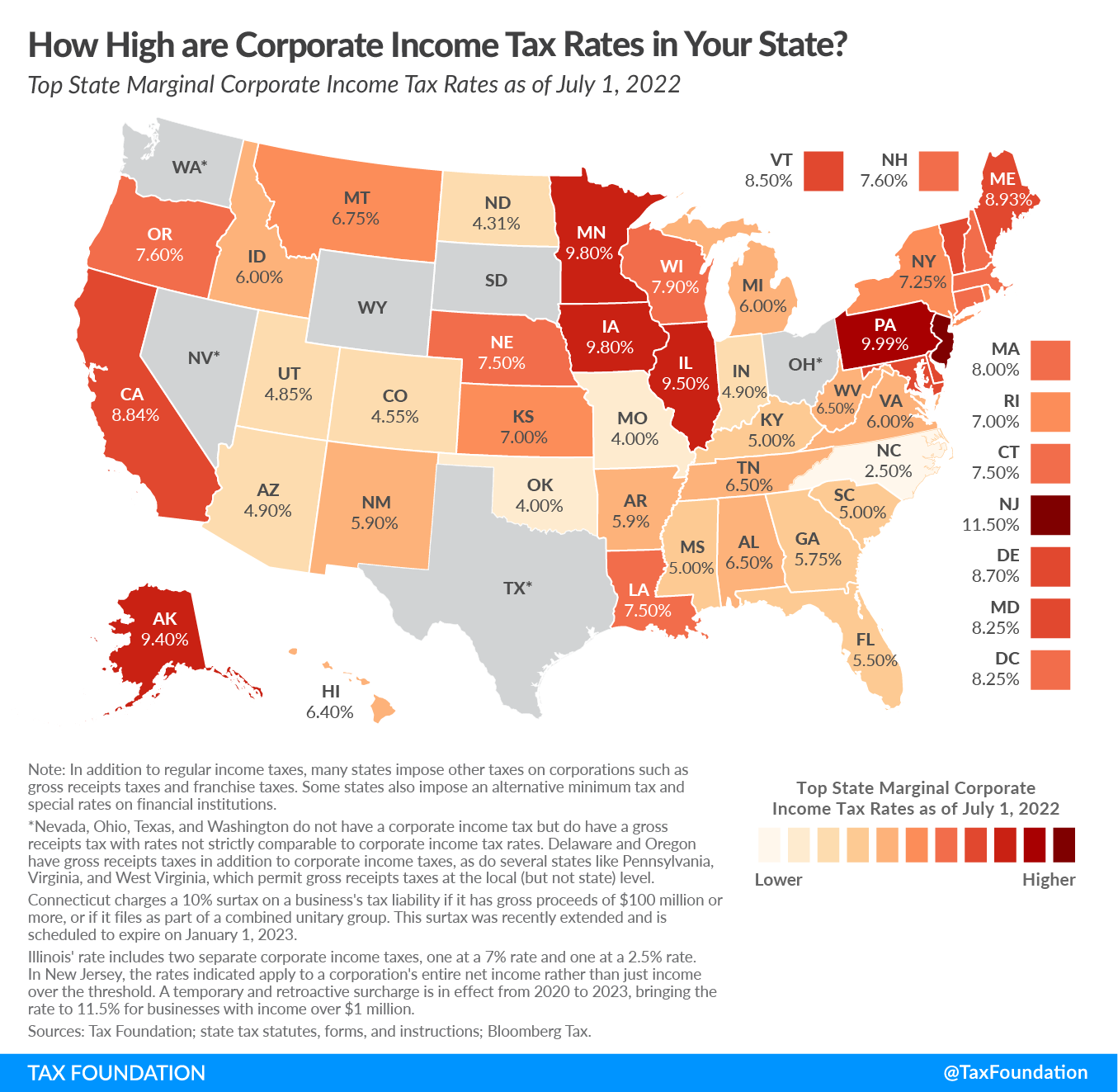

Pennsylvania Tax Rates Rankings Pa State Taxes Tax Foundation